Tuesday, January 17, 2006

Marketz : Implied Volatility Skews in the QQQQs

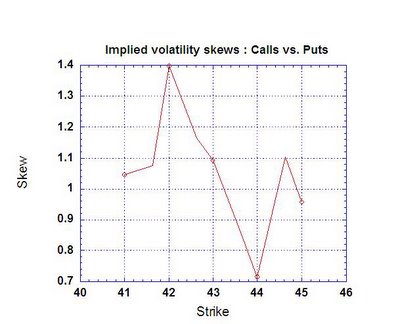

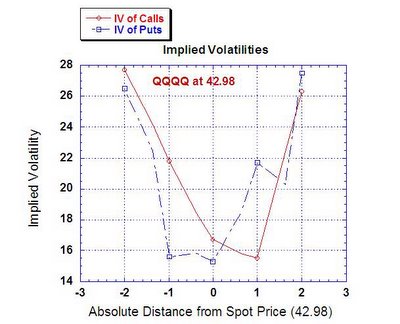

More information on the skews can be found in earlier posts. Its expiration week and out of the money options are cheaper than in the money options. Option pricing is biased towards a range bound market. At the money calls are slightly more expensive than puts-a slight upward bias. As this blog has pointed out, in the last several weeks, market bias in options pricing has been faded more often than not. Lets see what happens expiration week.

Technorati Tags : Marketz Volatility Skews Options Analysis QQQQs Calls Puts Market Direction Trends