Saturday, December 31, 2005

Sectorz : Foreign Stock Bust ?

"Coming after earlier stock losses, house depreciation will leave consumers with no piggy bank with which to support their consumption habits. Their 25-year borrowing-and-spending binge will be replaced by a saving spree. The big losers will be foreign lands that depend on American consumers to buy their surplus goods and services.

This scenario is beginning to unfold just as U.S. investors are stampeding to foreign stock markets, chasing the rallies that overseas bourses have lately been relishing. Some U.S. advisers are recommending a 33% allocation to foreign stocks, up from 20% two months ago. At current rates U.S. investors in 2005 will put $100 billion into mutual funds offering foreign stocks. Such a sum is equal to the flow into U.S.-only funds, which last year got twice what international funds did.

But investors are probably catching foreign stock cabooses, not locomotives. The dollar, which I think will keep climbing (with help from Fed rate increases), is eroding overseas stock gains. When U.S. consumer-spending weakness is felt globally, export earnings and economic activity abroad will nosedive and murder foreign stocks. Best advice: Unload your foreign equities now on all those bullish latecomers. Start first with the export-led Asia tigers, especially China. They'll suffer the most. "

Gary Shilling in Forbes, December 26, 2005

2005 saw heavy inflows into foreign stock funds. Is this trend going to continue through all of 2006 ?

Technorati Tags : Sectorz

Friday, December 30, 2005

Interesting Sectorz for 2006 : Senior Loans

Energy and Metals were definitely the sectors to be invested in, in 2005. Housing was also in play, on both the long and the short side, especially so if you possessed the prescience of Ken Heebner. So what are the plays for 2006 ?

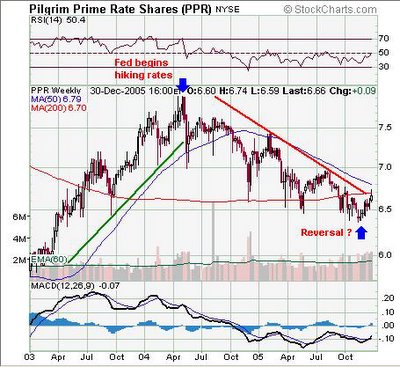

One sector thats crossed my radar screen is the asset class of senior loans. The yields on these are indexed to short term interest rates, which allow this asset class to benefit in a rising interest rate environment. Participation in this sector is possible through mutual funds and etfs. The ETFs range in size from assets of about a hundred million to about one and a half billion dollars. I like the closed-end senior loan etfs because of their liquidity.

2003 ('the year of reflation') was a great year for senior loan ETFs. PPR and VVR are the largest etfs in this class in terms of both assets and average daily trading volume. Big moves in these securities in either price or volume are less likely to be 'noise'.

If you look at the charts , you will find that almost every single senior loan ETF has been in a sustained downtrend through most of 2005. This has resulted in very high relative yields (7-10%) on these funds. However, in the last four weeks, many of these ETFs have seen positive OBV. The holiday week has been most interesting with several of these funds up on very heavy volume. Thats what caught my attention- above average volume in the last few days of Dec ? Somethings going on. (Only an opinion-never intended as advice).

Charts courtesy of stockcharts.com, prophet.net and optionsxpress,Inc.

Technorati Tags : Sectorz

Intraday : Resolution

The 40.40-40.50 intraday trading range on the QQQQs has been broken. The bollinger bandwidth has increased and the resolution , so far appears to be to the upside. (Merely an opinion; Never intended as advice)

UPDATE : The Nasdaq volatility index (VXN) has dropped by close to 3 % compared to yesterday's close inspite of the drop in the index. Either an indication that we go up from here or extreme complacency.

UPDATE : The resolution to the upside turned out to be fake and the QQQQs closed at 40.37 near the lows for the session. But VXN did not budge !! Where is the fear ?

Technorati Tags : Intraday

UPDATE : The Nasdaq volatility index (VXN) has dropped by close to 3 % compared to yesterday's close inspite of the drop in the index. Either an indication that we go up from here or extreme complacency.

UPDATE : The resolution to the upside turned out to be fake and the QQQQs closed at 40.37 near the lows for the session. But VXN did not budge !! Where is the fear ?

Technorati Tags : Intraday

Intraday Volatility Constriction in the Quadrupeds

Charts courtesy of Prophet and OptionsXpress,Inc.

So there is a similar volatility constriction again today in the QQQQs. How is this going to be resolved ?

Technorati Tags : Intraday

Thursday, December 29, 2005

Intraday Volatility Expansion in the Quadrupeds

Charts courtesy of Prophet and OptionsXpress

On Thursday just after 3 pm, we witnessed a textbook expansion in volatility in the QQQQs after the 20 period, 2-SD Bollinger bandwidth had constricted in the 10 day chart. The resulting explosive move occurred in the direction of the primary intraday trend-DOWN. Increase in volume (again intraday) provided confirmation.

Technorati Tags : Intraday