Saturday, January 21, 2006

Stockz & Marketz : Ominous action in GOOG

I notice that the recent bipolar behavior of the market has confused even some old market hands.

The market goes on to make new highs preserving all upwards trend lines and then registers its biggest one day drop since 2003 (I'm talking nasdaq here). The volume during its recent run-up was good but then the volume on friday was heavier. To almanac readers, the first five up days of January portends a good year for the market but then volatility is also increasing from historic lows. Earnings of bellwethers have disappointed but then all the excess M3 created by the fed has few other places to go to (certainly not real-estate anymore-If anything, money is coming out of real-estate). Oil and Gold are mighty strong but then Treasuries are unfazed too.

All these mixed signals are of little help in our relentless quest to fathom short-term and intermediate-term market trends and thus time the market. Anyplace then, where the signals are unambiguous ?

I think I might have one here. One word : Google. As THE LEADING STOCK OF THIS LATE CYCLICAL BULL MARKET, it is a reliable proxy for market sentiment. What can lead the market higher can also drag it lower, as we saw Friday.

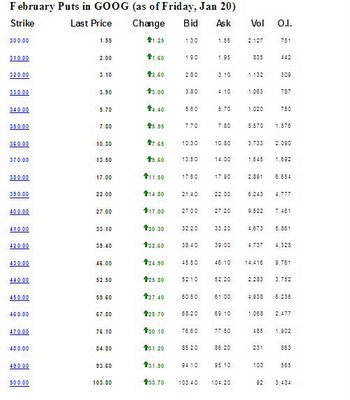

We know institutions have chased this stock higher. We know retail loves it too. Here is what I find most ominous about GOOG. The corresponding open interest in the near months is piddling to say the least. And I checked out every month including Jan'07 and Jan'08 LEAPS. Not many outstanding puts anywhere.

The absolute overall put interest across all strikes and months amounts to about 400,000. Friday saw a lot of puts-so that 400,000 number will increase but its still be around that figure. Also remember that a lot (in fact a majority) of these puts are in distant months and at strikes far away from the spot price of google stock (last trading at $399.46). Its only near-the-money, near month put open interest that provides short-term protection toe stock price. And those are conspicuously small for a high beta stock like GOOG. Considering the dramatic run-up in google's stock price from its IPO price of $85 to $475, I would have expected a lot more puts being purchased for protection. But that is not the case.

That tells me that a) Long-term holders have been too complacent and b) Lot of present stock holders are late-entrants to the party who felt no need to purchase put protection because they entered the stock at fairly high levels to begin with. Short interest ? The Jan run-up eviscerated the shorts.

GOOG has 296 million shares outstanding. About a 100 million of them are owned by insiders. About 150 million were owned by institutions (I say were, because Fri's 40 million volume may have changed things somewhat). And Henry Blodgett's blog has been talking about the fundamentals relating to google's stock price-love the spirited discussion on that site.

The point is : I think all sane holders of goog stock will either try to lock in atleast a portion of their profits or buy more put protection. And shorts are going to start piling up. All this will put further pressure on the stock price. It will not if the number of new buyers is so great that it compensates for the above pressure. But given developments on the GOOG-Govt front and upcoming earnings on Jan 31 , prospective new buyers are probably going to adopt a wait-and watch stance. And as GOOG goes, so goes the market.

Technorati Tags : Stockz Marketz speculation GOOG puts market-leader market-direction

Someone said on elitetrader.com, "Vegas wasn't built on winners" - and neither was Wall Street.

<< Home