Tuesday, January 10, 2006

Marketz : Where do we go now ?

QQQQs made an interesting candlestick pattern today called side-by-side white candles. According to my 1990 edition of Seiki Shimizu's "The Japanese Chart of Charts", there are three kinds of side-by-side whites :

a) upside gap side-by-side whites

b) downside gap side-by-side whites

c) side-by-side whites in stalemate

There is no intervening gap, so a) and b) can be safely ruled out. On to c) :

To be conclusively identified as c) , a long upper shadow on the yesterday's candle would have been helpful. But we dont have that help.

I quote the master : On a rising market, when this type of "side-by-side whites" appears, we can tell that the market has come close to its limit and is lacking the support needed to move any higher. Buyers up to this point have exhausted all their energies and even though a new high price is set with a large volume, an "upper shadow" is formed. Naturally, on the following day, we see an inevitable low starting price, however, with more defensive buying and short covering, we see another white line formed which is where we get the name "side-by-side whites in stalemate"

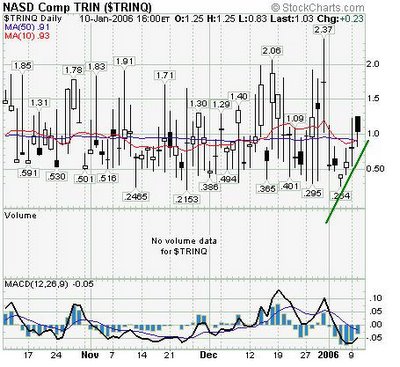

Lets dig deeper. here's a 1 month chart of the TRIN. The absolute value of the TRIN is close to 1, which suggests an equilibration of buying and selling pressure or a stalemate. However, the trend of the last few days is UP (in otherwords from buying to selling) and the 10 day simple moving average is turning up.

Its still too dangerous to challenge a tape as strong as this and shorts are outta the question. But it maybe a good time to take profits (I did-liquidating my long QQQQ 39 calls and long SMH 37.50 calls at the end of the session). Consolidation and range-bound action in the near term is more likely. Even if a strong pullback is going to manifest itself, I suspect a more authoritative reversal signal such as a DOJI will appear first.

Technorati Tags : Marketz TRIN Candlestick charts SMH QQQQs Calls Puts Market Direction Trends